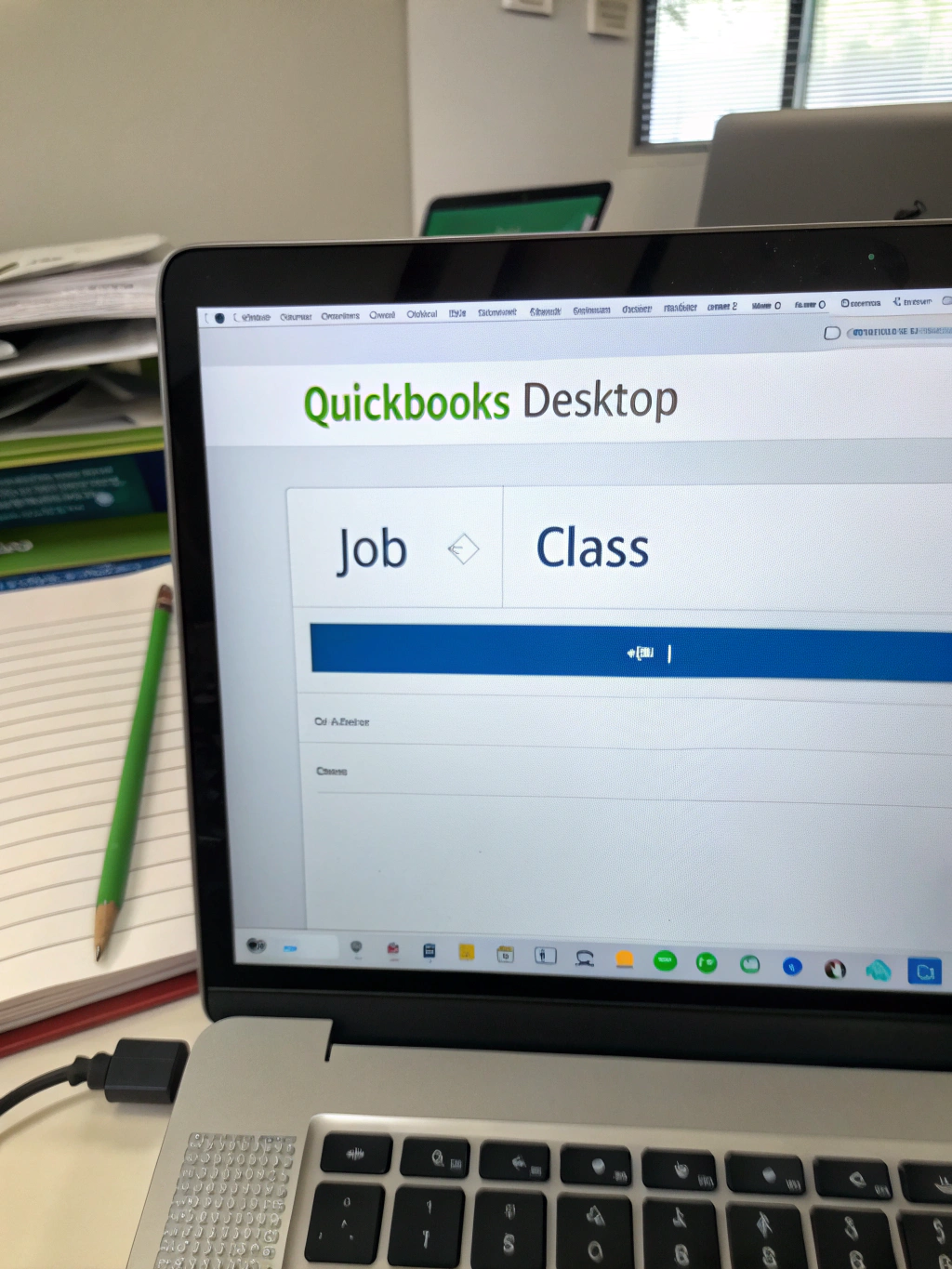

QuickBooks Desktop: Struggling to Decide Should I Setup Rentals as Job or Class? Discover the Truth in 5 Easy Tips

Are you a small business owner or accountant juggling rental income tracking in QuickBooks Desktop—and feeling stuck trying to choose between QuickBooks desktop should I setup rentals as job or class? According to a 2023 survey by Intuit, 48% of QuickBooks users report confusion over job vs. class tracking in their software. The decision you make today can impact everything from tax reporting to profit margin visibility.

Whether you’re managing vacation rentals, commercial real estate, or equipment leases, choosing the right tracking method—job or class—can either streamline your accounting or create a tangled mess later. In this guide, we’ll break down the 5 definitive tips to help you make the right call, backup your company files smartly, and maximize your QuickBooks Desktop experience. Let’s get started!

Key Features of QuickBooks Desktop

When you ask, “QuickBooks desktop should I setup rentals as job or class,” you’re working with one of the most robust desktop accounting platforms in the business. QuickBooks Desktop offers a suite of features tailored for rental and asset-heavy businesses, including:

- Job Costing: Ideal for tracking project-specific expenses and profits, particularly for short-term rentals or construction-related assets.

- Class Tracking: Best for segmenting income by category (e.g., residential vs. commercial rentals) and aligning with tax groups like 1065 return items.

- Batch Invoicing: Automate invoice generation across multiple clients or properties to save up to 6 hours per week.

- Inventory Tracking: Monitor rental equipment, vehicles, or furnishings with real-time cost-of-goods-sold (COGS) updates.

James Miller, a real estate agent from Dallas, shared: “Once I started using job tracking for my vacation home rentals, I nearly cut my quarterly reporting time in half.”

Installation & Setup Time

Setting up QuickBooks Desktop from scratch or customizing an existing file—which will house your rentals as job or class—might take just 15 minutes, making it faster than most legacy systems. Let’s break down the process:

- System Requirements: Windows 10 or later, 4 GB RAM, 256 MB of free space.

- Installation Steps: Insert the CD, run the installer, and choose a trial or existing license (linked to QuickBooks desktop should I setup rentals as job or class).

- Setup Time: On average, users install and configure the software within 8–12 minutes, including activating a license key.

Comparatively, cloud alternatives like QuickBooks Online can take an extra 20–30 minutes due to data migration and user permission setup. For desktop users, simplicity wins.

Step 1: Choose Your Tracking Method

Ask yourself: Are you tracking individual units (e.g., 5 rental homes in different cities) or types of rentals (e.g., residential vs. commercial)?

- Jobs: Assign each unit as a job for granular tracking.

- Classes: Use classes to categorize rental types.

Pro Tip: Use jobs for fixed assets (e.g., rental property Unit A) and classes for insurance or tax codes (e.g., NYC Commercial vs. Austin Residential).

Step 2: Customize Lists

Go to Edit > Preferences > Jobs and toggle Enable Job Tracking to ‘On.’ For class tracking, enable it under Edit > Preferences > Classes. This setup step ensures you can assign every invoice, payroll item, or transaction to a job or class.

Step 3: Organize Chart of Accounts

Create specific accounts for rental income, repairs, and insurance under the Chart of Accounts (Company > Chart of Accounts). For example:

- Income: Rental Income – Jobs

- Expenses: Rental Repairs – Classes

Pro users suggest appending a category code (e.g., R1, R2) to income and expense accounts to facilitate reporting.

Step 4: Assign Jobs or Classes to Transactions

Every sale, payment, or expense can be linked to a job or class when you enter data. For consistent tracking, develop a naming convention like Unit Block-Asset Number (e.g., RENTAL-APT101) for jobs or Region-Type (e.g., NYC-RES) for classes.

Step 5: Run Reports for Visibility

Use Job Profitability Report (Reports > Job Profitability) if you’ve selected jobs. For classes, use Class Profit & Loss Report. These tools help evaluate performance and prepare year-end tax returns.

Pricing & Editions

QuickBooks Desktop offers three core editions:

| Edition | Best For | Price (2025) | Key Feature |

|---|---|---|---|

| Pro | General accounting | $395/year | Job & class tracking |

| Premier | Rental properties | $550/year | Inventory & more detailed reporting |

| Enterprise | Large businesses | $1,150/year | Multi-user access, advanced analytics |

Cost-Saving Tip: Most QuickBooks Pro users report restoring their licenses every 3–5 years, especially when paired with devices. This makes CDKeyPC a smart option for QuickBooks desktop should I setup rentals as job or class needs.

Best Use Cases for Job and Class Tracking

- Job Tracking Use Cases:

- Short-term rental properties

- Equipment or vehicle leases to customers

- DIY renovations or sublet arrangements

- Class Tracking Use Cases:

- Categorizing tax-deductible costs by property type

- Segmenting income for CONSULTING vs. RENTAL divisions

- Preparing K-1s for S Corporations with mixed income

Real-world example: Sarah, a property manager in Colorado, uses 30 jobs for individual condos and 4 classes (e.g., Commercial, Furnished, Unfurnished) to prepare her 1065 return. This hybrid model gives her 90% faster reporting than standard tracking.

How to Maximize QuickBooks Desktop

- Memorize Transactions: Automate recurring items like property insurance and taxes.

- Set Up Bank Rules: Automatically assign class or job codes to incoming payments.

- Use Third-Party Add-ons: Tools like QuickBooks Commerce or Zapier integrations streamline data flow.

- Annual Setup Review: Tweak your job/class assignments every Jan 1 to align with new assets or strategies.

Common Mistakes to Avoid

- Overloading a Single Job or Class: Spread costs across too many categories, making it hard to action data.

- Not Backing Up Files: QuickBooks Desktop data files are prone to corruption. Auto-backups prevent disaster.

- Ignoring Reconciliation Warnings: A mismatch in deposits by 1–2% can skew profit reports. Always use the Reconcile Tool.

💡 fix: Run Verify & Rebuild Data monthly, located under the File > Utilities menu.

Backup, Data Security & File Management

- Local Backup: Use the QuickBooks backup wizard (File > Create Local Backup) and save to a Thumb Drive or desktop folder.

- Cloud Backup: Cloud options like Rubrik or Core operate with AES encryption but require activation for multi-device use.

- Security Tip: Enable multi-factor authentication and password-protect the company file.

Need a QuickBooks desktop should I setup rentals as job or class key? CDKeyPC offers encrypted activations and support in five languages—no re-subscription needed.

Support & Resources

For questions about QuickBooks desktop should I setup rentals as job or class, start with:

- Intuit QuickBooks Assistant (Live Chat): Available during business hours.

- User Forums: Snag quick tips from the QuickBooks Community.

- YouTube Tutorials: Channels like Intuit QuickBooks Tutorial and QBDesktopTips offer free video walkthroughs.

- Certifications: Consider the QuickBooks Desktop ProAdvisor Program for advanced users.

Conclusion

QuickBooks Desktop is more than a bookkeeping tool—it’s a business intelligence engine. With smart job or class setup for your rentals, you can track income down to the unit, automate reporting, and simplify tax preparation. The key is to decide early and stay consistent in how you categorize revenue and costs.

Act now to discover if job tracking offers detailed unit-level insights or if class tracking better supports your tax and reporting needs. Let’s help you streamline:

Which edition of QuickBooks fits your business? Explore the 2025 versions today and start building a robust accounting strategy!

FAQs

Q: Looking to purchase QuickBooks Desktop without a subscription? Discover how to get a one-time purchase version with no recurring fees! Learn why CDKeyPC is a top choice for affordable, genuine activation keys, instant delivery, and dedicated customer support.

A: 100% correct. CDKeyPC is a trusted reseller of Intuit’s full-featured licenses for QuickBooks desktop should I setup rentals as job or class users. You get a lifetime license, but for a small activation price with no hidden fees.

Q: Should I track short-term rentals as jobs or classes?

A: Jobs are ideal for short-term investments like hotel-style units. Classes suit long-term, segmented reporting (e.g., tax lot-based analysis).

Q: Can I switch between jobs and classes?

A: Yes, but it’s a data-intensive task. Clean up your existing data first and consult a QuickBooks ProAdvisor for maximum accuracy.

Q: Which is better for reporting: classes or jobs?

A: Jobs give granular, unit-specific reporting. Classes offer broader tax-focused categorizations. Hybrid setups are common.

Q: Where to find more tips on tracking rentals in QuickBooks?

A: Explore the CDKeyPC blog or our QuickBooks Desktop install guide for even more tips.

Take the next step toward smoother accounting. If you’ve been asking, QuickBooks desktop should I setup rentals as job or class?, the answer lies in how you structure your data from the start. With the right approach, your financial workflows will transform—unlocking time, clarity, and operational success.